- News Updates

- PSU Watch

- Defence News

- Policy Watch

- हिन्दी न्यूज़

- Jobs Watch

- States News

- Event News

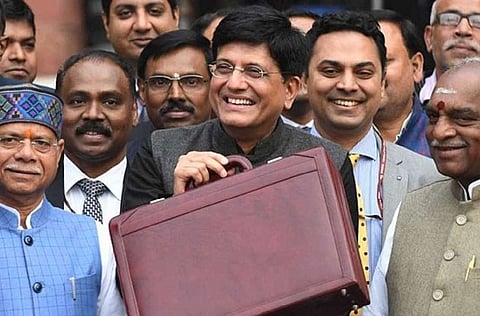

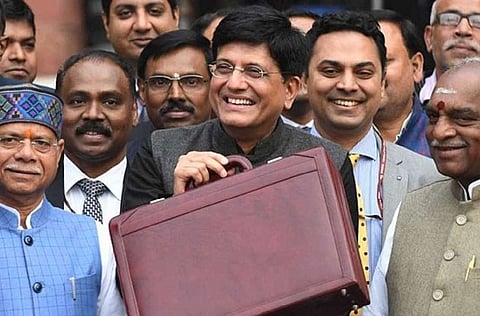

New Delhi: While presenting the budget, when Finance Minister Piyush Goyal came to the point when he announced a tax rebate for people with annual income up to Rs 5 lakh, the whole Parliament rang with a chorus hailing Prime Minister Narendra Modi and media houses across the spectrum relayed breaking news in extra bold letters, suggesting that the tax exemption had been doubled from the previous limit of Rs 2.5 lakh to Rs 5 lakh. However, on closer inspection, it appears to be a colossal confusion.

The 2019 interim budget proposed a full tax rebate for individuals with annual income of up to Rs 5 lakh under Section 87A. Since this is a rebate and not a slab change, it will not impact the tax incidence of those with larger incomes though it will have some impact for those whose salaries are under Rs 10 lakh as they can add home loans and tuition fees to get additional benefits.

However, as has been pointed out by tax experts, a rise of even Rs 1,000 over Rs 5 lakh will take away the benefits of the rebate.

Shalini Jain, Partner, EY India was quoted as saying by ET, "This means that anyone with net taxable income up to Rs 5 lakh will not be required to pay any taxes. However, anyone with net taxable income above Rs 5 lakh will not be able to avail this tax benefit and only get standard deduction benefit."

As per the full text of Goyal's speech released by the Ministry of Finance, the finance minister said, "Though as per convention, the main tax proposals will be presented in the regular budget, small taxpayers especially middle class, salary earners, pensioners, and senior citizens need certainty in their minds at the beginning of the year about their taxes. Therefore, proposals, particularly relating to such class of persons should not wait. Hence, while for the present the existing rates of income tax will continue for FY 2019-20, I propose the following… Individual taxpayers having taxable annual income up to Rs 5 lakhs will get full tax rebate and therefore will not be required to pay any income tax. As a result, even persons having gross income up to Rs 6.50 lakhs may not be required to pay any income tax if they make investments in provident funds, specified savings, insurance etc."

There's no change in the tex exemption limit: income up to Rs 2.5 talk for resident individuals below the age of 60 years is exempt from tax. Senior citizens aged 60 years and above but below 80 years with an income of up to Rs 3 lakh are exempt from tax. And for super senior citizens (above the age of 80 years), income up to Rs 5 lakh is exempt from tax.