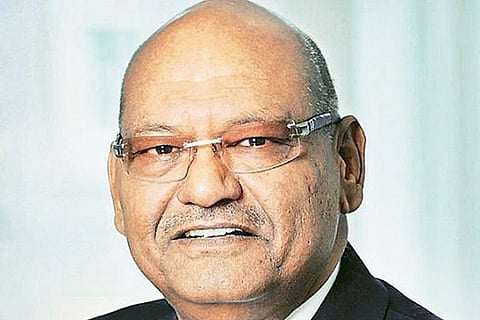

Vedanta Chairman says, Govt should not be in business

New Delhi: While asserting that private sector pays more taxes and creates more jobs, Vedanta Chairman Anil Agarwal reiterated on Friday that the government should not be in business. The statement comes in the backdrop of the government readying five PSUs for disinvestment in order to raise a corpus of Rs 1.05 lakh crore. Vedanta had bagged two major PSUs — Hindustan Zinc and BALCO — during the first widespread disinvestment drive undertaken in the history of India under the premiership of late Prime Minister Atal Bihari Vajpayee. While pointing out how the valuation of these companies have improved after the government sold them off, the Vedanta Chairman said, "I have accepted what the government was ready to dispose off and then turned these assets around."

There's scope for disinvestment: Vedanta Chairman

"If the government brings its ownership down by 50 percent, it will have $1 trillion," Agarwal said. He added, "I am not in favour of privatisation of all public sector companies. However, the government should bring in public as shareholders and the government should not be in business."

'Hope to see more disinvestment in mineral resources, downstream oil sector'

On the road to the $5 trillion economy, the Vedanta Chairman said that he expects the government to disinvest more PSUs in mineral resources and downstream oil sector. The statement comes a day after Agarwal expressed his willingness to bid for BPCL, which the government is slated to take up for disinvestment.

'Conducive environment for business'

Speaking at 'FICCI's 92nd Annual Convention – 'India: Roadmap to a $5 Trillion Economy', Agarwal said, "It is important for us to take risk. The potential that India has for Indians is unprecedented. It is a conducive environment for business to grow and the best time for all of us to be risk-takers."